Hybrid cars throw lifeline to platinum metals

Hybrid cars throw lifeline to platinum metals

Reuters | September 10, 2024 | 7:04 am Markets Cobalt Nickel Palladium Platinum

A surge in sales of hybrid cars as electric vehicle take-up slows is set to provide an unexpected boost to demand for platinum group metals (PGMs) in the coming years, similar to the extended lifespan now predicted for coal.

![]()

PGMs – principally platinum and palladium – face a long-term structural decline in demand as their main use has been to clean auto exhausts, a process that is not needed in pure EVs.

Sign Up for the Precious Metals Digest

![]()

A few years ago, the prospects for PGMs, and producers such as Anglo Platinum, Impala Platinum and Sibanye Stillwater, appeared grim as EV sales soared, and the drop-off in demand was expected to be steep.

But a tapering in growth of EV sales, and a surge in demand for hybrid cars that need catalytic converters to curb pollution, have given PGMs a new lease of life that could put a floor under prices and keep some mines open for longer.

“You’re still facing an outright demand decline, but there’s not an immediate collapse, which could have been the projection in some (previous) scenarios,” said Marcus Garvey, head of commodities strategy at Macquarie Bank in Singapore.

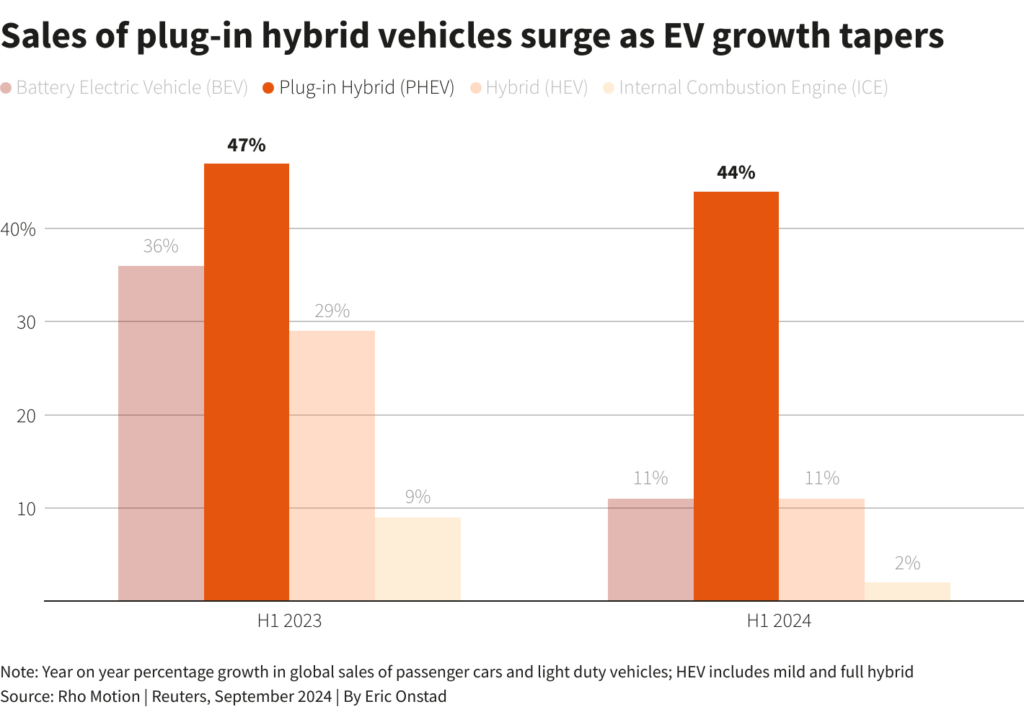

The increase in sales of pure EVs globally in the first half of 2024 slowed to 11% year-on-year, while plug-in hybrid (PHEV) sales jumped 44%, according to consultancy Rho Motion.

For EVs, the figures are a big fall-off from two years ago when sales rocketed 77%.

Popular PHEVs include BYD’s Song and the BMW 3 Series.

Garvey said the PGM situation had some parallels to coal, which is being phased out as governments slash carbon emissions, but will still be needed for years until more renewable energy is rolled out.

Weak PGM prices are currently curbing investment in production and if miners decide to shut operations due to low profitability, prices could become volatile.

“The scope for the market to get tighter than currently projected seems very, very high if we start to see some producer response,” Garvey said.

Hybrid strength

The rise of hybrids could last until 2030 or longer, extending the period when PGMs are needed, analysts said.

“The shift to hybridization could be quite meaningful for the longer-term sustainability of the PGM industry,” said Wilma Swarts, director of PGMs at consultancy Metals Focus.

The weakness in EV sales means that combined sales of petrol and hybrid cars, which was expected to be flat last year, climbed by 9%, according to catalyst maker and PGM specialist Johnson Matthey.

“This alone added 600,000 ounces to our automotive PGM demand estimates,” it said in a report, adding that total auto PGM demand rose 8% last year to 13.1 million ounces, the second highest total ever.

Surge in plug-in hybrids

The biggest growth area has been in PHEVs in China, which saw sales surge by 70% in the first half.

Consultancy Alix Partners has more than doubled its forecast for the global share of PHEVs to 12% by 2030 from 5% two years ago.

“We have marked it up quite significantly because of the developments in the last couple of years,” said Gerrit Reepmeyer at Alix.

A survey by Alix this year showed that in the world’s two biggest car markets, the United States and China, more than 80% of consumers who were likely to buy an EV were veering towards a PHEV rather than a pure EV.

That could boost PGM demand as about 10-15% more platinum metals are needed in PHEVs than petrol vehicles because engine pollution is higher when starting a cold engine, Swarts said. Petrol engines in hybrids, especially PHEVs, are infrequently used and so often start cold.

Shifting resources

Analysts say the trend towards hybrids is expected to persist until EVs can compete on price with petrol cars worldwide, batteries offer longer driving ranges, and more charging stations are rolled out.

Many carmakers are happy shifting resources to hybrids, which have higher margins than EVs.

Last week, the world’s biggest automaker Toyota was reported to have slashed its EV production plans for 2026 by a third, while Sweden’s Volvo Cars scrapped its target of going all electric by 2030.

Ford, Toyota and Stellantis have all burnished their hybrid plans in recent months.

“Automakers are trying to find that sweet spot in terms of profitability, consumer acceptance and compliance with regulations,” Swarts said.

New US auto emission regulations also bolster the outlook for hybrids by allowing automakers to comply with an EV mandate by producing more gas-electric hybrids.

The US and Canada have seen the biggest gains in conventional hybrid sales, up 33% in the first half of 2024.

Each additional million cars that need catalysts will add about 150,000 ounces of PGM demand, Swarts said.

In China, where EVs are already similar in price to petrol cars, many consumers are opting for extended range plug-in hybrids. In such vehicles the petrol engine is solely used for charging the battery, providing longer driving distances.

No help for nickel, cobalt

The shift to hybrids is expected to curb demand for key battery materials such as cobalt and nickel, since hybrid batteries are smaller than those in EVs.

The weighted average battery size for PHEVs for the first half of this year was 23.3 kilowatt hours (kWh), versus 64.5 kWh for pure battery EVs (BEVs), according to consultancy CRU.

“The shift towards PHEVs and the pullback of BEV targets is likely to be an overall negative to battery material demand growth over the next few years,” said Sam Adham, head of battery materials at CRU.

(By Eric Onstad and Polina Devitt; Editing by Veronica Brown and Mark Potter)