The silver lining: A look at the recent surge in silver prices

The silver lining: A look at the recent surge in silver prices

5 min read | Updated on October 30, 2024, 06:59 IST

---

SUMMARY

~40%! That’s the kind of returns Silver has delivered this year. Silver’s demand has outstripped its supply for the past 4 consecutive years. Its industrial applications continue to rise across the industries of tomorrow. As such, the rise in prices is driven by more than just a need to diversify - but fundamental reasons that can support prices. It's therefore no surprise, that market experts believe this rally still has legs.

---

Silver today stands out as a key metal, with its applications in sectors ranging from electronics and solar panels to medical technology.

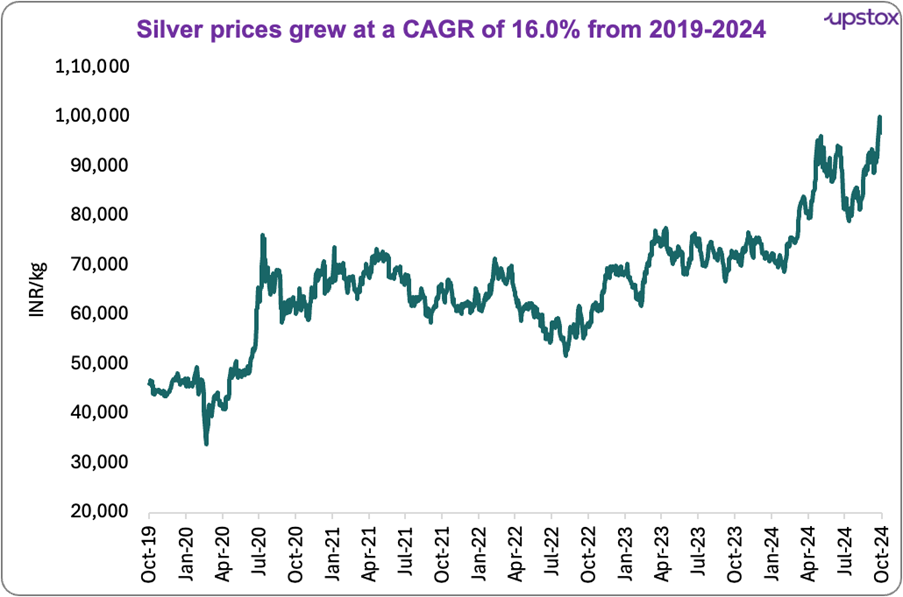

Over recent months, silver’s versatility and demand have contributed to a significant price rally. The year 2024 has seen it rise over 40% year-to-date to reach ~₹1,01,000/kg, with certain market experts believing that it can reach ~₹125,000 on the MCX in the coming year, a projected return of ~24%.

This growing popularity has also led many to perceive silver as a store of value (after gold), safeguarding against external economic volatility.

Source: Investing.com

Trends in silver demand and supply

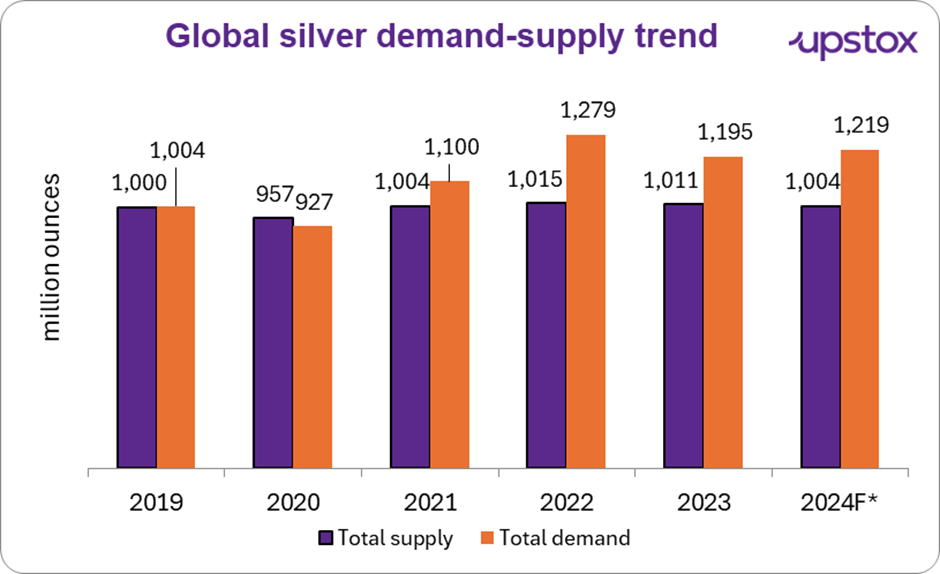

Globally silver’s demand has been steadily increasing at a pace of 4% pa over the past 5-6 years, even as silver supply has remained relatively flat, explaining why prices have been spiking

Source: silverinstitute.org ; *2024F - forecasted

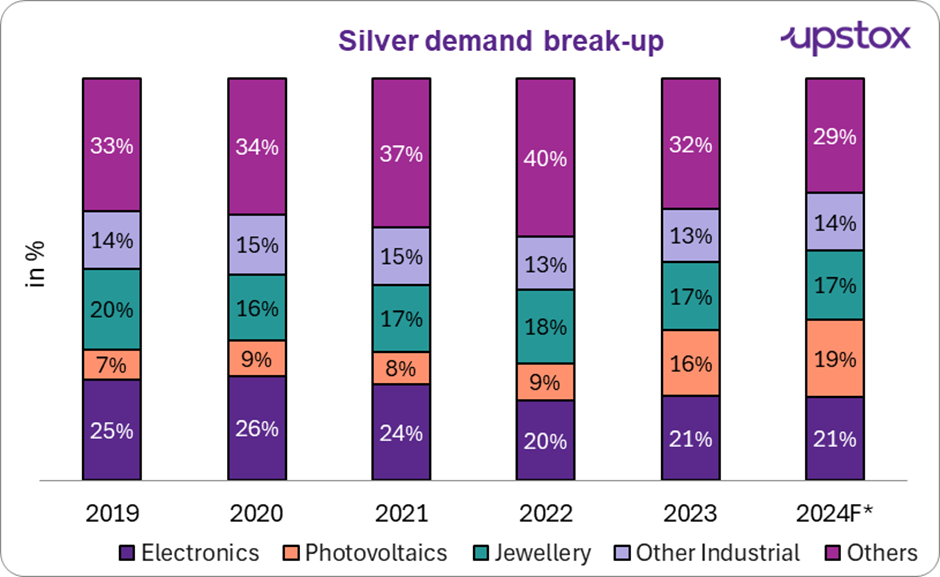

Within silver demand - we also look at sources of demand and their growth in potential in the chart below

Source: silverinstitute.org; *2024F - forecasted

As we highlighted above, a substantial portion of silver’s value comes from its industrial applications. As one of the best conductors of electricity and heat, silver is essential in sectors like:

Solar power: Silver is crucial for photovoltaic (PV) cells in solar panels, making it a key player in the shift to renewable energy. With solar capacity expected to more than double by 2025, demand for silver in PV applications has been growing at a 25.4% CAGR over the past five years and is expected to persist. Due to silver’s conductivity, it enhances solar panel efficiency, and as the push for green energy continues, PV is set to remain a major driver of silver demand.

Automotive: Silver is integral to modern vehicles, particularly in electric and hybrid cars where it’s used in contacts and connectors. As electric vehicle adoption rises, automotive demand for silver is expected to reach 90 million ounces by 2025.

Electronics: Silver’s conductivity makes it invaluable in electronics, with applications ranging from multi-layer ceramic capacitors to silver-coated windshields.

Other key reasons:

Central bank purchase: While central banks have traditionally been known to purchase gold, silver also seems to be attracting their attention. For instance, the Russian government recently announced that it would begin adding silver to its precious metal reserves. Experts believe this could lead to other countries replacing this move.

Federal Reserve policy: Recent rate adjustments by the Federal Reserve have heightened expectations of potential rate cuts in the near future. With inflation still a concern, investors could be eyeing silver as a hedge.

Geopolitical tensions: The ongoing conflicts in regions such as the Middle East and Eastern Europe have contributed to uncertainty, making perceived safe-haven assets like silver more attractive.

Investing in silver: An alternative to gold?

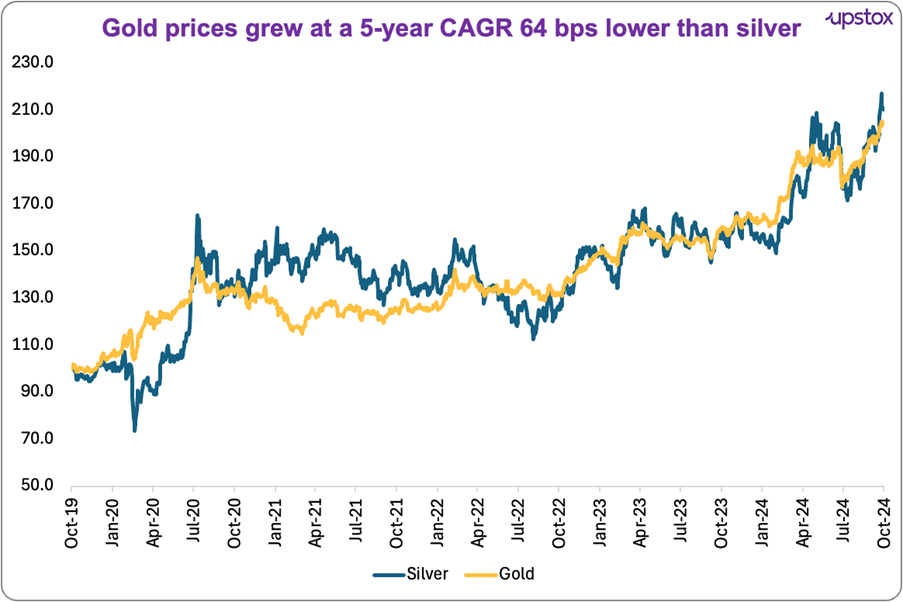

While gold has long been the preferred choice for conservative investors, silver’s return potential has made it an appealing alternative. In the current economic climate, silver’s dual appeal as an industrial and investment asset could offer a balanced addition to portfolios seeking both growth and risk mitigation.

Source: Investing.com

Here’s a look at the top 5 silver mutual funds and ETFs available in India

| Scheme Name | AUM (₹ crore) | 3 Months* | 6 Months* | 1 Year* | 2 Years* |

|---|---|---|---|---|---|

| Nippon India Silver ETF | 4,477 | 18.5 | 19.8 | 35.5 | 65.9 |

| ICICI Pru Silver ETF | 3,714 | 17.8 | 19.4 | 35.7 | 66.4 |

| DSP Silver ETF | 231 | 18.4 | 19.8 | 36.1 | 66.4 |

| HDFC Silver ETF | 321 | 19.8 | 22.1 | 38.1 | 68.1 |

| Axis Silver ETF | 137 | 18.5 | 20.6 | 35.3 | 67.1 |

| Average | 1,772.4 | 18.6 | 20.3 | 36.1 | 66.7 |

Source: Moneycontrol; *Absolute returns; data as of 30/10/2024

Key risks you should know before investing

Price volatility: Prices can be highly volatile, influenced not just by domestic but global factors. This volatility makes short-term investments in silver particularly risky.

Industrial demand: Given its industrial applications, if demand drops, the price can decline sharply.

Storage and insurance costs: Like with all commodities, physical silver investments require secure storage and insurance, adding ongoing costs that can eat into potential profits.

Rate sensitivity: Similar to other commodities, it can often see price decreases when interest rates rise, as investors tend to shift towards fixed-income securities for stability.

Currency fluctuations: As a global commodity, its prices are impacted by movement in global currencies, particularly the U.S. dollar

Conclusion

Silver’s recent price surge reflects both its enduring value and expanding industrial role. While gold remains an iconic investment, silver’s versatility and demand in green technologies position it as a potentially high-yielding asset in the near future. For investors, allocating a portion of their portfolio to silver might provide a unique hedge against economic uncertainties while tapping into emerging trends in industrial demand.

Read the full article at: The silver lining: A look at the recent surge in silver prices